Buy now pay later (BNPL) has been picking up steam among curious consumers in Thailand. This type of financing has grown in popularity because it is seen as a more flexible and consumer-friendly alternative to traditional credit products.

It is reported that BNPL fintechs have already diverted US$8 to US$10 billion (THB280 billion to THB350 billion) of annual revenue away from banks globally. Thai banks would need to adapt fast and be more progressive to regain and retain consumers, as 70 percent of BNPL users would be willing to use BNPL offerings from their banks if they were available.

The COVID-19 pandemic impacted the growth of the BNPL industry in Thailand, forcing consumers to shop online with some turning to its services to manage their finances during these uncertain times.

A study by Mastercard shows BNPL has room for growth as most Thai consumers (89 percent) are aware the instalment plans as a payment option but only a handful (26 percent) have used it last year.

However, 55 percent stated they were more likely to use BNPL for sizeable or emergency purchases, while 80 percent were interested in paying their bills using the option.

Thailand’s digital consuming and spending behavior

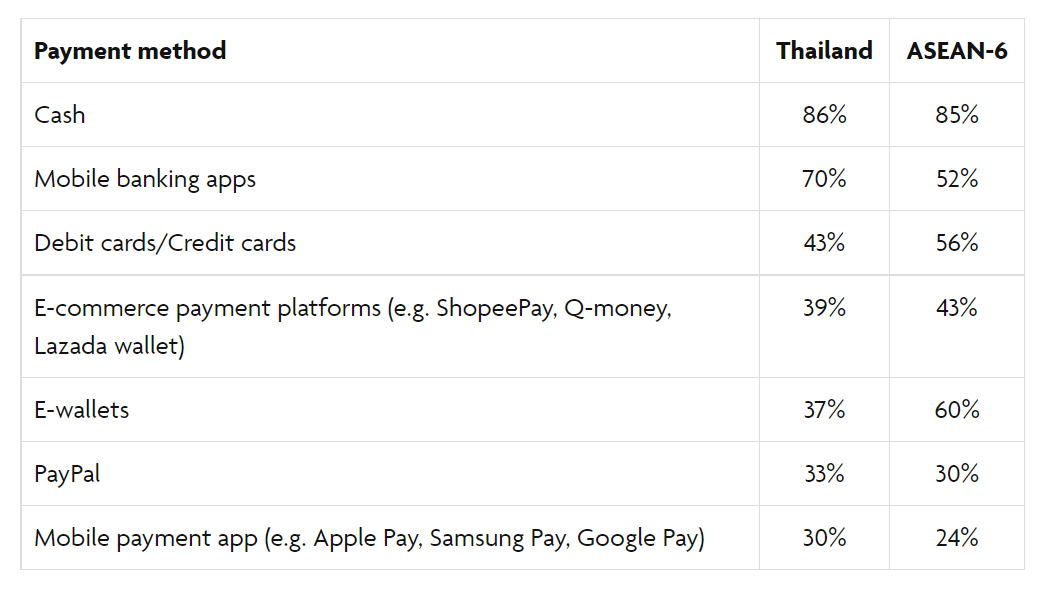

A UOB Group insight analysed Thailand’s digital consumption and spending behavior. It stated that 70 percent of payment methods used by Thai consumers are made via mobile banking apps for in-store and online transactions, higher than the ASEAN average of 52 percent.

In addition, 44 percent also preferred digital or online banking channels, higher than the ASEAN average of 35 percent. Thailand also has the highest percentage of active users in digital currencies, with one in five people using cryptocurrency and other central bank digital currencies (CBDCs).

Payment methods used in the last three months for both in-store and online payments in Thailand, compared with the ASEAN average. Source: FinTech in ASEAN 2021 research

BNPL which is slowly gaining momentum in Thailand is second behind credit cards in preferred pay-later methods. The reason is that some consumers prefer to use something other than BNPL due to a lack of understanding and awareness of how the feature works.

According to Mastercard, the most common reasons for Thais using BNPL is that it helps to save money for a purchase without the wait (63 percent), purchases come with no or low interest payments (60 percent), and without delays (60 percent).

Does Buy Now Pay Later pose a threat to traditional banks?

Although the BNPL market is there for the taking, some think it would not pose a significant threat to banks. According to Moody’s Investors Service, the BNPL payment option encounters several challenges, like lack of consumer awareness, the availability of the service in rural areas, and the relatively high cost of using the service.

The report also stated, “Some BNPL businesses could expand their offerings to products such as unsecured loans, which can help improve their profitability, but even if they do, their small scale will limit their ability to take on banks.”

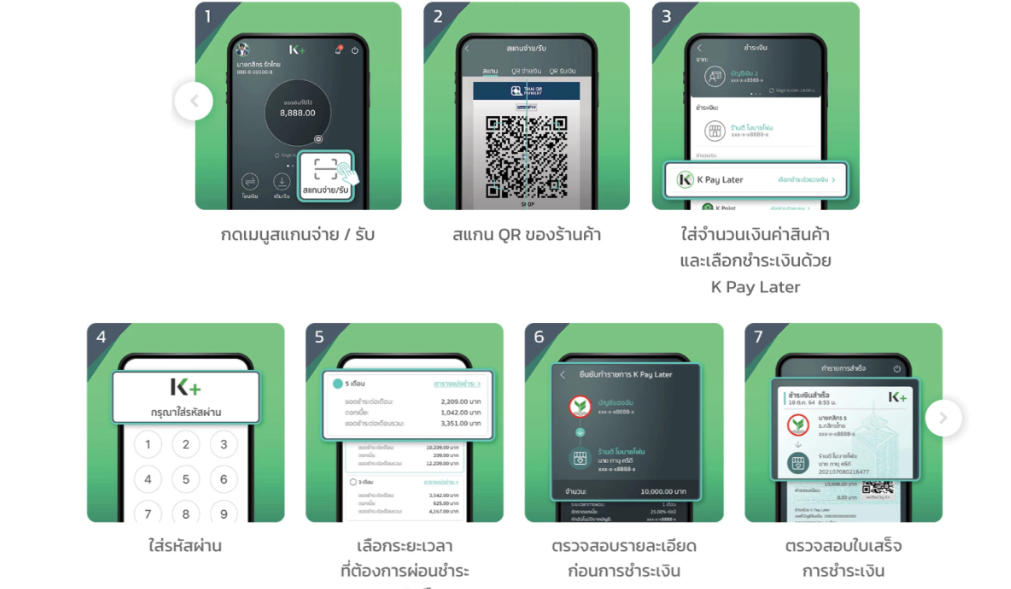

However, one such bank has already taken the proactive step to offer BNPL services. Kasikornbank has launched K PAY LATER, a first of its kind in Thailand that offers BNPL features to consumers.

K PAY LATER allows consumers to purchase products and services in instalments, with a maximum interest not exceeding 25 percent per year. The maximum loan limit is 20,000 baht, and applications are accessible as no documents or collaterals are needed.

As long as applicants are of Thai nationality, between the ages of 20 to 70, and have a savings account at Kasikornbank, their applications can get approved within three minutes. They can use the service to pay their utility bills, buy electronic gadgets and even pay for their social media ads.

Why is Buy Now Pay Later popular in Asia?

Asian consumers are more comfortable using credit products, meaning more people purchase products on borrowed credit. This trend is also due to the younger population’s increasing purchasing power and awareness of leveraging financial services to buy products and services they desire.

Moreover, BNPL is becoming more and more accepted by merchants in Asia, which means that customers have more options when it comes to using BNPL.

Research and Markets reported that BNPL payments are expected to grow by 67.1 percent annually to reach US$2,980.8 million (THB 104.3 million) in 2022.

BNPL payment adoption is expected to clock a CAGR of 33 percent, with the BNPL GMV of US$1,783.8 million (THB62.4 million) in 2021 expected to increase to US$16,529.9 million (THB578.5 million) by 2028.

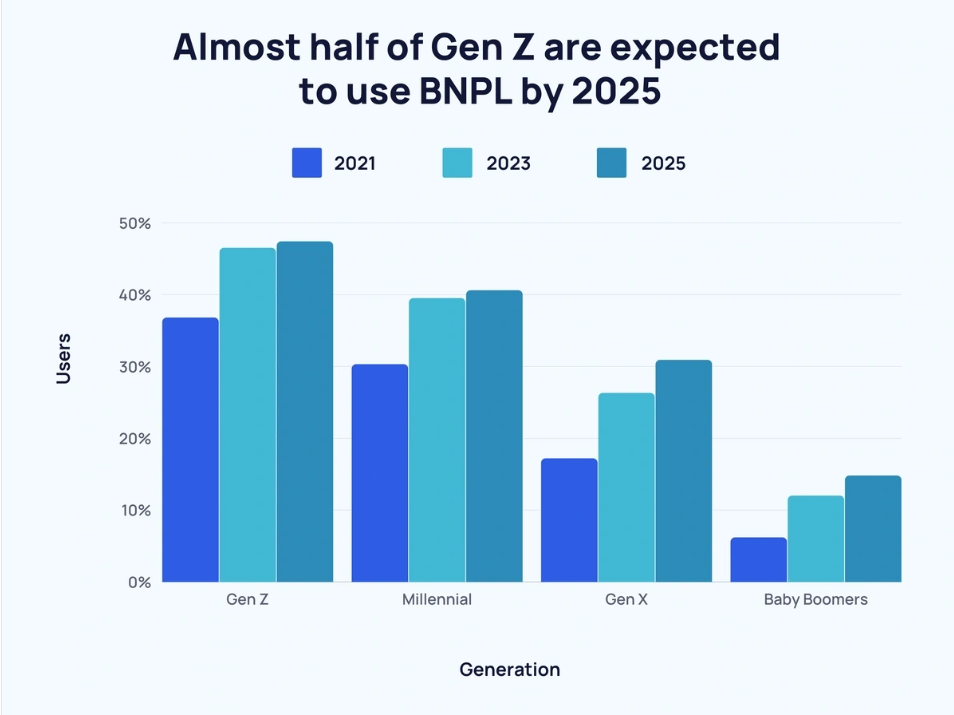

According to eMarketer, Gen Z is the generation to that uses BNPL the most. And adoption rates among Gen Z are expected to increase to 47.4 percent in 2025.

The ever-growing e-commerce market has also resulted in BNPL being one of the most preferred purchasing methods, with shopping so convenient and easy at the fingertips.

With a revenue of US$10.5 billion (THB367.4) in 2021, Thailand is the 22nd largest market for e-commerce.

The country is projected to have an e-commerce market of US$ 19.26 billion (THB674.1 billion) in 2022 and is expected to grow to US$ 38.72 billion (THB1.3 trillion) by 2027; it is no wonder that BNPL has become one of the preferred ways to purchase a product or service.

Buy Now Pay Later is here to stay for the long run

BNPL represents an alternative payment method to traditional cash or credit card payments. It offers flexibility to consumers and encourages purchases, which benefits retailers offering the BNPL service as it increases revenue for them.

Although there is credit risk, such as consumers defaulting payments which would result in losses for retailers, regulators are looking to foster a healthy environment for BNPL to stay in for the foreseeable future.

The post Buy Now Pay Later (BNPL) Gaining Momentum in Thailand appeared first on Fintech Singapore.

Comments